Currently Empty: ₹0.00

Blog

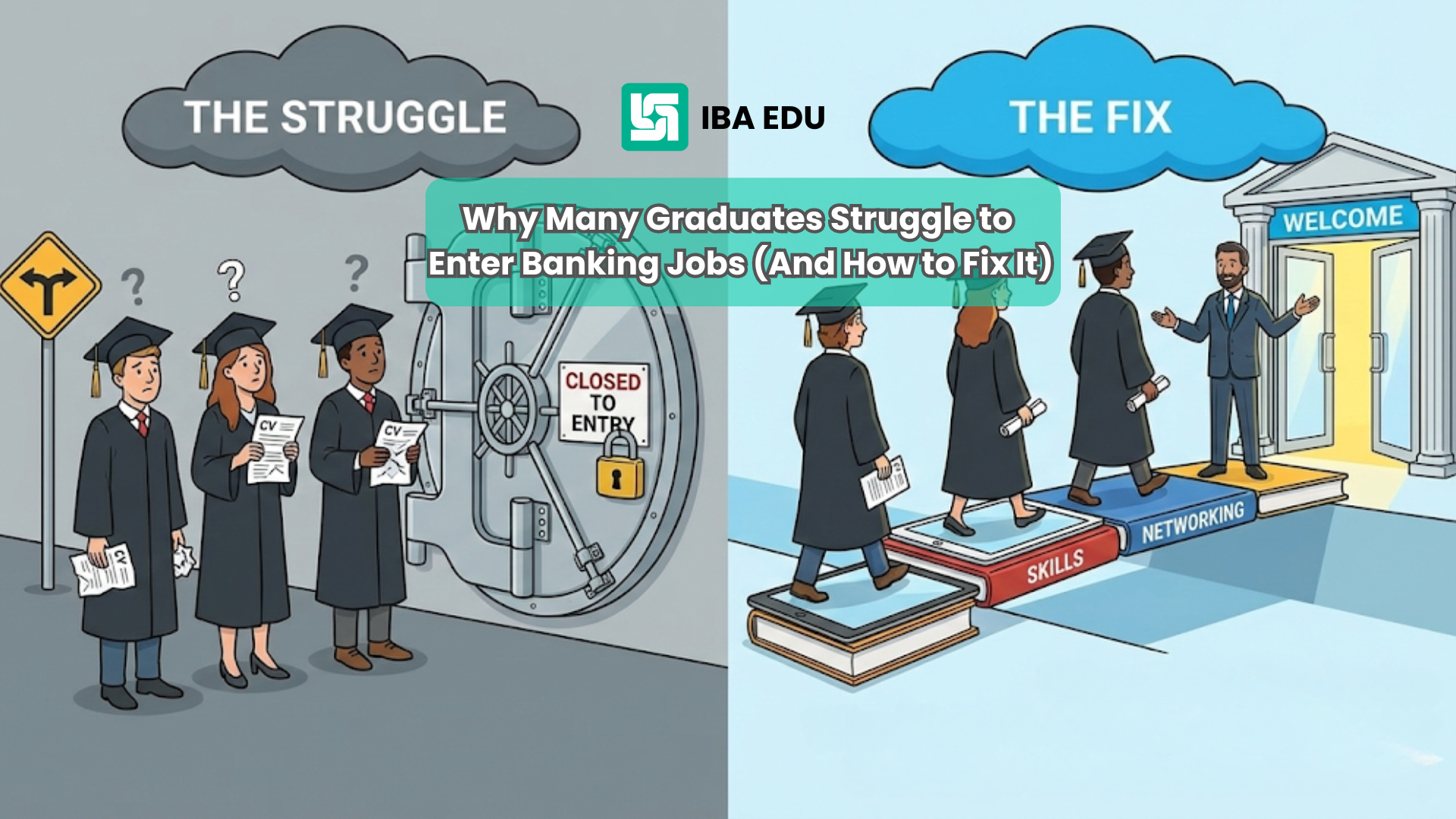

Why Many Graduates Struggle to Enter Banking Jobs (And How to Fix It)

The Indian banking sector is expanding at an unprecedented rate, yet thousands of commerce and management graduates find themselves “unemployable” when they walk into a private bank interview.

If you’ve been applying for entry-level banking jobs but aren’t getting callbacks, the problem likely isn’t your effort—it’s your strategy. Here is an honest look at why the struggle is real and how you can leapfrog the competition.

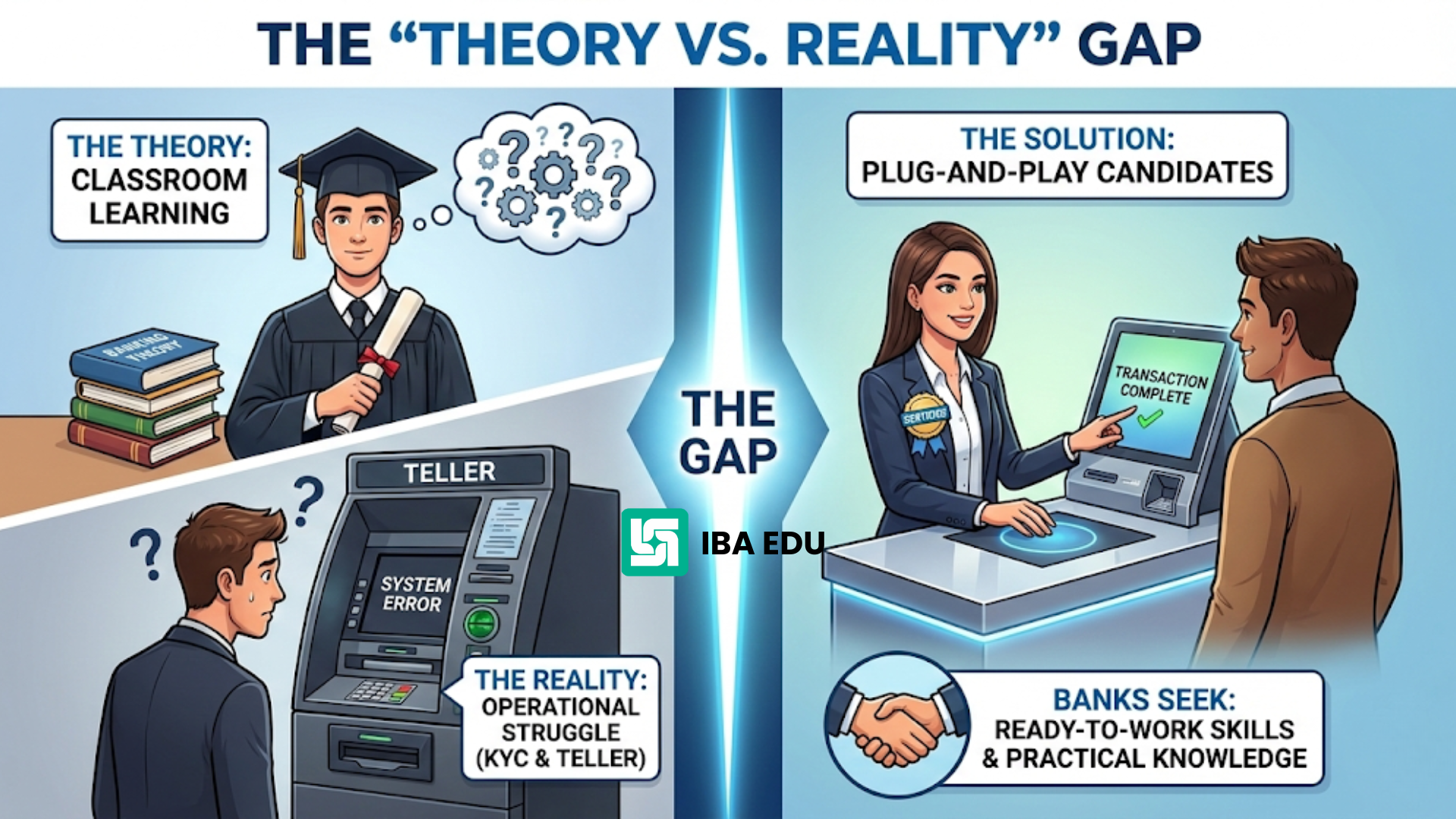

1. The “Theory vs. Reality” Gap

Most college degrees focus on the history of banking or the definition of a cheque. However, a Banking Career for Freshers in 2026 requires immediate technical knowledge.

-

The Struggle: Graduates know what a bank is, but they don’t know how to operate a teller workstation or process a KYC (Know Your Customer) document.

-

The Solution: Banks are looking for “Plug-and-Play” candidates. Practical exposure to bank operations is now a requirement, not an elective.

2. Lack of Operational Confidence

Banks are high-pressure environments where a single decimal point error can cause significant issues.

-

The Struggle: Freshers often exhibit “operational anxiety” during interviews. When asked how to handle a cash tallying discrepancy or a difficult customer, they freeze because they’ve never done it.

-

The Solution: By undergoing hands-on banking training, you replace fear with muscle memory. Knowing how to navigate a banking software interface before your first day gives you an “Unfair Advantage.”

3. Underestimating Soft Skills & Sales

Many students believe banking is just about sitting behind a desk and counting money. In reality, modern banking is a Relationship Management game.

-

The Struggle: Many graduates lack the “Corporate Grooming” needed to handle high-net-worth individuals or the communication skills to explain complex financial products.

-

The Solution: Developing a “Banker’s Persona“—including professional communication and sales etiquette—is just as important as knowing the Repo Rate.

4. The “Shortlist” Trap

A 90% score in college might get your resume shortlisted, but it won’t get you past the final round.

-

The Struggle: Recruiters see thousands of identical resumes. If yours only lists “Education,” you look exactly like everyone else.

-

The Solution: Adding role-specific certification from a recognized institute like IBA EDU signals to the recruiter that you are serious and already trained in compliance and banking protocols.

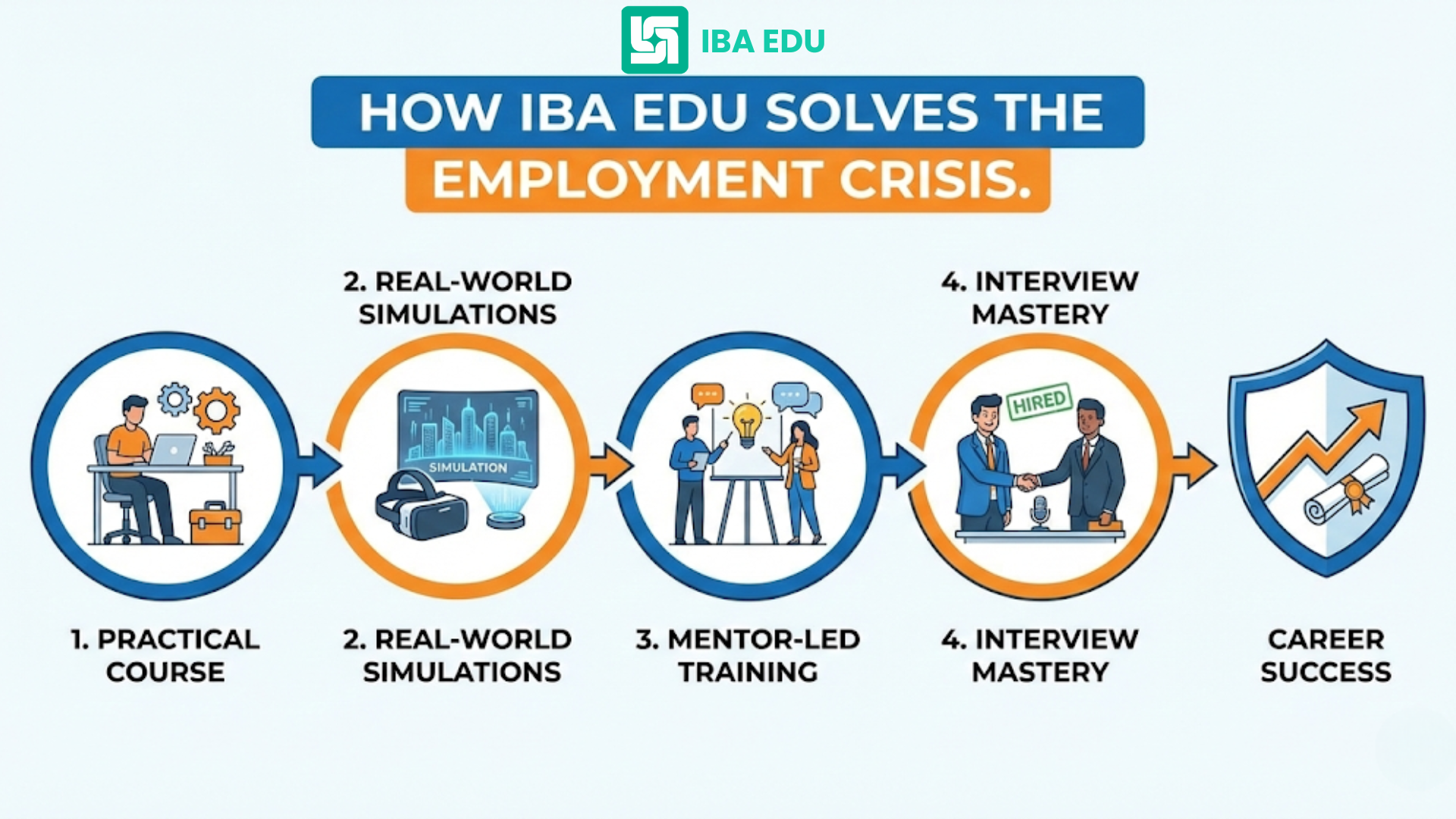

How IBA EDU Solves the Employment Crisis

At IBA EDU, we don’t just teach you about banks; we turn you into a banker. Our Practical Banking Course is specifically designed to eliminate the four struggles mentioned above.

-

Real-World Simulations: Use live workstations to practice account opening and cash handling.

-

Mentor-Led Training: Learn from experienced bankers who know exactly what HDFC, ICICI, and Axis Bank look for in new hires.

-

Interview Mastery: We provide specialized coaching to help you articulate your value to hiring managers.

Don’t Just Be a Graduate. Be a Professional.

The difference between a “struggling graduate” and a “successful banker” is often just 60 days of the right training.

Apply for our 2026 Banking Mastery Program – Join the Waitlist

Frequently Asked Questions (FAQs)

1. Why is a college degree often not enough to get a job in a private bank? Most degrees focus on theoretical knowledge and historical banking concepts. However, modern banks like HDFC, ICICI, and Axis Bank require job-ready skills. They look for candidates who already understand KYC protocols, banking software, and teller operations. Without practical training, graduates often struggle to pass the technical rounds of interviews.

2. I have no prior experience; can I still join the IBA EDU Banking Program? Absolutely! Our program is specifically designed for freshers and final-year students. We bridge the gap by providing a “Live Banking Experience” where you practice in a simulated bank environment. You’ll gain the confidence of someone with months of experience before you even attend your first interview.

3. What specific banking roles will I be trained for? Unlike general courses, IBA EDU provides role-specific training. We prepare you for high-demand positions such as:

-

Relationship Manager (Sales & Service)

4. How does the 50% scholarship for top performers work? At IBA EDU, we reward merit and commitment. At the end of the 2-month training program, we evaluate students based on their performance in live simulations, mock interviews, and operational accuracy. The top 3 candidates in every batch receive a 50% scholarship as a refund on their course fees.

5. Is the training conducted online or offline? We offer a hybrid model. You can choose between in-person training at our center (for hands-on workstation experience) or online sessions that fit your college schedule. Both modes include 1-on-1 mentoring from experienced bankers to ensure you get personal attention.

Stop being just another applicant on a pile of resumes. Don’t let “lack of experience” hold you back from a high-growth career in Finance. Join the IBA EDU Banking Mastery Program and experience the real world of banking before your first day on the job.

👉 [Enroll Now for the 2026 Summer Internship Batch] 👉 [Click Here to Schedule a Free Career Counseling Call]