Currently Empty: ₹0.00

Blog

Beyond the Degree: How to Choose Your Role in Modern Banking

The Era of the “Certified Banker”: Why Your Degree is Just the Starting Line.

In 2026, banks aren’t hiring resumes; they are hiring capabilities. Stop the job-hunt cycle and start your career strategy by choosing the role that matches your DNA.

Download the 2026 Banking Role Competency Map | Consult with an Industry Expert

The traditional path to a banking career for freshers used to be simple: get a degree, pass an interview, and learn on the job. But the landscape of 2026 has shifted. With the integration of AI, high-frequency digital transactions, and a massive focus on personalized wealth management, the “generalist” is out. The “specialist” is in.

If you are a final-year student or a recent graduate, the challenge isn’t just getting into a bank—it’s choosing a path where you will actually thrive. A degree gets you to the door, but role-specific expertise is what turns the key.

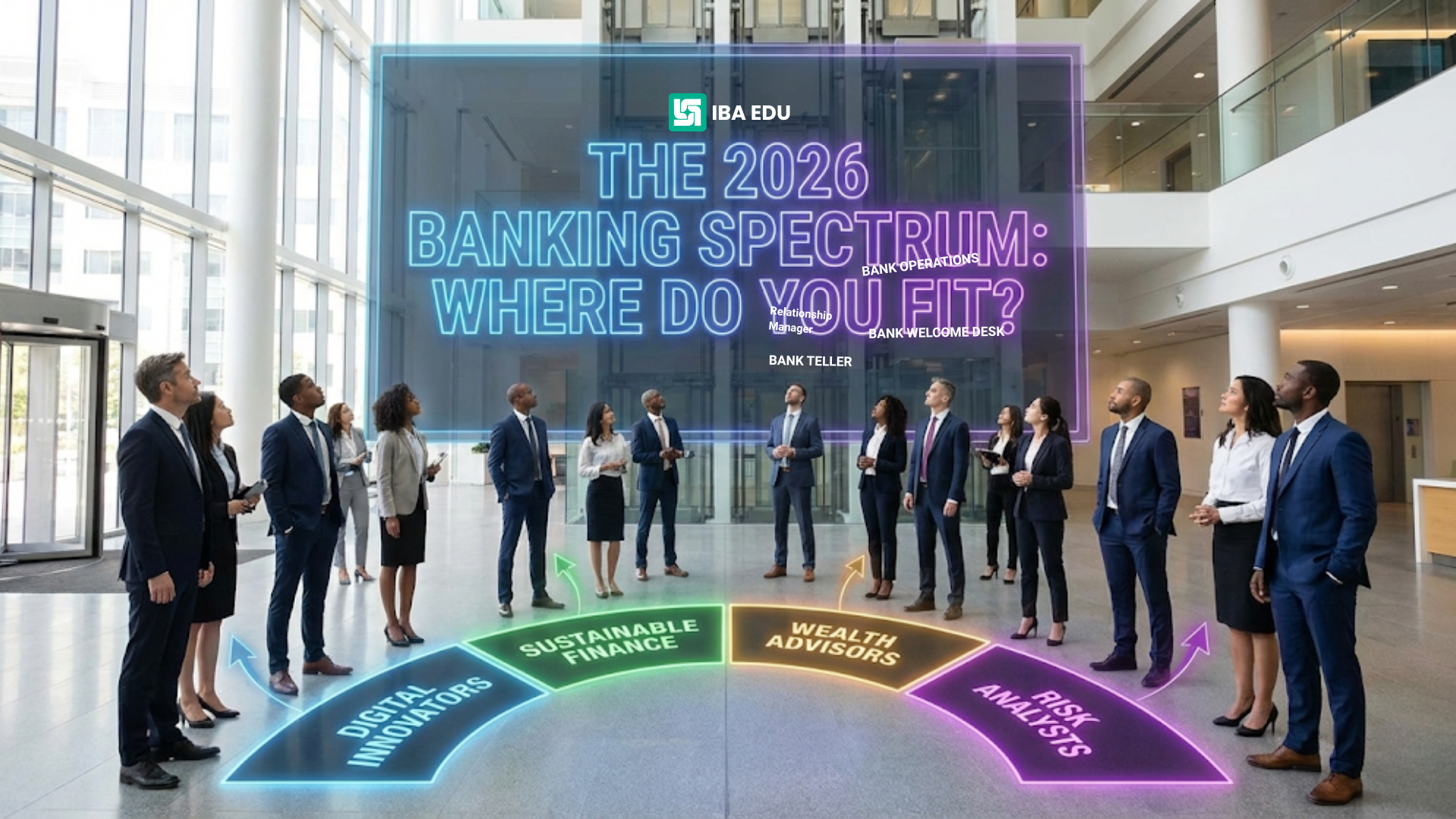

The 2026 Banking Spectrum: Where Do You Fit?

Choosing a career in finance without understanding the roles is like buying a suit without knowing your size. It might look good on paper, but it won’t fit the reality of your workday. Here is an authoritative breakdown of the four pillars of modern banking roles.

1. The Growth Engine: Relationship Management (RM)

The RM is the face of the bank’s growth. If you have high emotional intelligence and a flair for persuasion, this is your domain.

-

The Mandate: Managing high-net-worth portfolios and driving revenue through financial products.

-

Essential Skills: Sales psychology, investment advisory, and advanced communication.

-

Growth Potential: Fastest route to senior management and high-incentive earnings.

2. The Foundation: Banking Operations

Operations is the silent engine that keeps the bank running. This path is for those who value precision, logic, and structure.

-

The Mandate: Handling trade finance, clearing, loan processing, and audit compliance.

-

Essential Skills: Operational accuracy, risk assessment, and mastery of core banking software.

-

Growth Potential: Transition into Risk Management or Chief Operating Officer (COO) pathways.

3. The Frontline: Retail Banking & Service

The “heart” of the branch. This role requires multitasking and a “customer-first” mentality.

-

The Mandate: Managing live teller counters, account opening, and immediate problem-solving.

-

Essential Skills: Cash tallying, conflict resolution, and frontline compliance.

-

Growth Potential: Leads to Branch Manager and Regional Head positions.

4. The Future: Digital Banking & FinTech Operations

The intersection of finance and technology. This is for the tech-savvy graduate who wants to lead the digital shift.

-

The Mandate: Managing digital payment ecosystems and leveraging AI for customer insights.

-

Essential Skills: Data literacy, digital security protocols, and tech-adaptability.

-

Growth Potential: Pivotal roles in FinTech strategy and digital transformation.

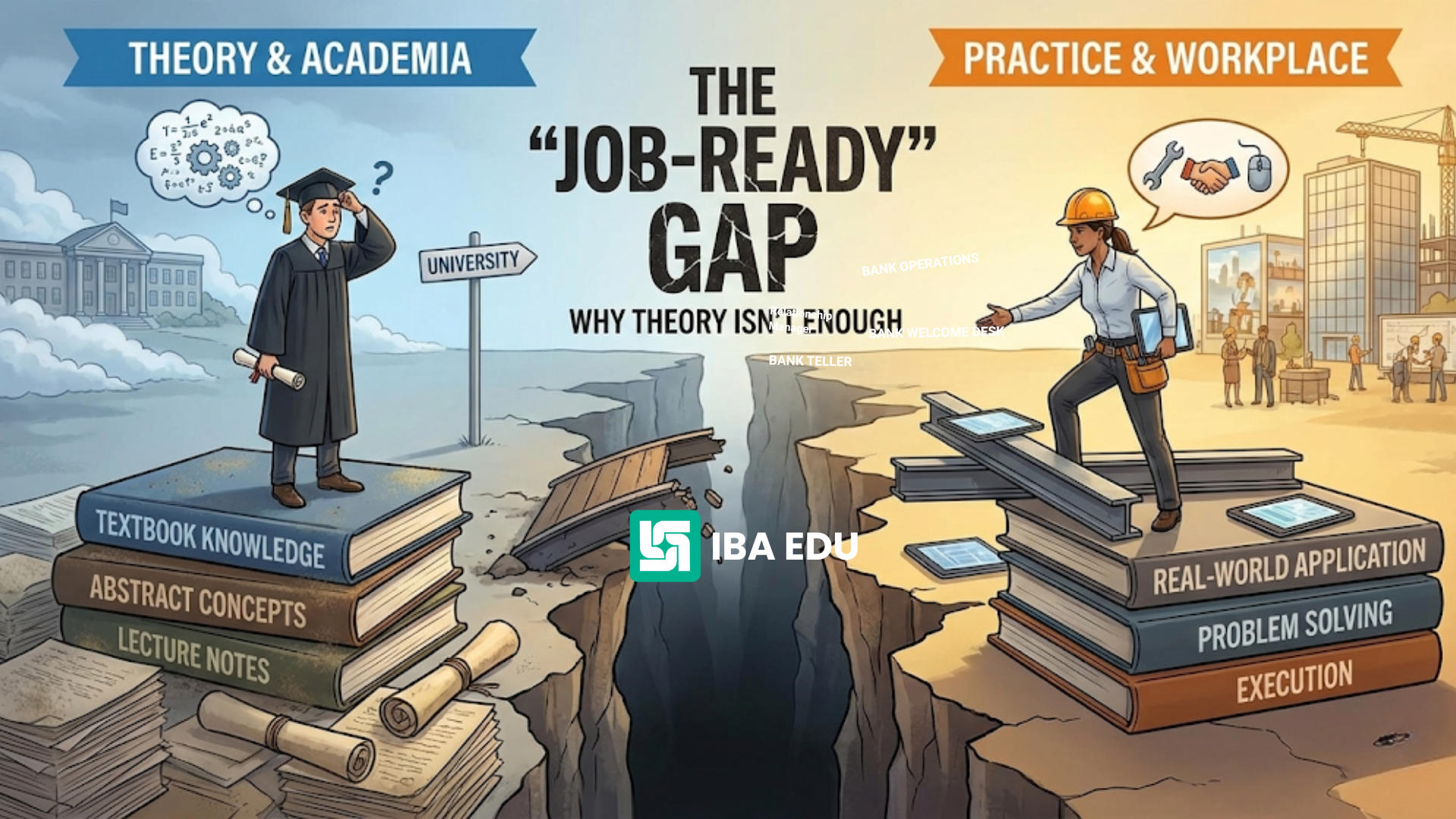

The “Job-Ready” Gap: Why Theory Isn’t Enough

The most common reason for rejection in entry-level banking jobs is a lack of practical context. Recruiters often hear candidates explain what a bank does, but they rarely see candidates who know how to do it.

Banks are currently facing a high “training cost” for freshers. When you walk into an interview already knowing how to balance a teller drawer or handle a KYC discrepancy, you aren’t just a candidate—you are a solution to their training problem.

A certification in practical banking training is no longer a “bonus”; it is the new industry standard for those aiming for Tier-1 private banks.

IBA EDU: The Only Platform Built for the 2026 Banker

At IBA EDU, we realized that the gap between college and the branch was too wide. We didn’t just build a course; we built a Mock Branch.

Our curriculum is designed by experienced bankers who have served in the trenches of India’s top financial institutions. We don’t teach you to pass a test; we teach you to master a workstation.

-

Role-Specific Modules: We align your training with the specific career path you chose in our assessment.

-

Live Simulation: Experience the pressure of a live teller counter and the complexity of RM meetings before your first day.

-

Industry Placement: Our network doesn’t just look at your degree; they look at your IBA EDU Competency Score.

Take the Strategic Lead in Your Career

Don’t leave your future to chance or a generic resume. The banking sector in 2026 rewards the prepared. Understand your role, master your skills, and enter the industry with the authority of a professional.

Ready to find your perfect fit?

👉 Take the IBA EDU Career Assessment Quiz |

👉 Apply for the 2026 Banking Mastery Batch

IBA EDU — Where Banking Careers Are Built Practically, Not Theoretically.