Currently Empty: ₹0.00

Blog

Mastering the Counter: 7 Essential Cash Handling Skills Every Banking Aspirant Needs in 2026

From College Graduate to “Zero-Error” Banker.

Most freshers lose their banking jobs within the first 3 months due to cash differences. Don’t be one of them. Learn the elite skills of professional tellers and secure your future.

[Enroll Now for ₹4,999 – Limited Time Offer]

The Reality of Modern Banking in India

The dream of a stable, high-paying career in a private bank is more attainable than ever in 2026. However, there is a massive “Experience Gap” between what college teaches and what a bank branch demands.

At IBA EDU, we’ve analyzed hundreds of interview panels for roles like Welcome Desk, Teller, and Relationship Manager. The #1 thing they search for isn’t just a degree—it’s operational confidence. Can you handle ₹10 Lakhs in cash during a Monday morning rush without breaking a sweat?

1. The “Blind Count” & Denomination Mastery

Machines can fail, but a master teller never does. You must learn the manual verification of Indian currency.

-

The Skill: Rapidly sorting and counting notes by hand to verify machine counts.

-

Why it matters: It builds an extra layer of security and shows the branch manager you are meticulous.

-

Pro-Tip: Always count the cash twice—once when the customer hands it over and once before you put it in the drawer.

2. Identifying Counterfeit Currency (FICN Detection)

Fake Indian Currency Notes (FICN) are becoming more sophisticated. As a teller, you are the final filter.

-

Key Security Features: You must master the check for the color-shifting thread, the see-through register, and the intaglio printing on ₹500 and ₹2000 notes.

-

The Risk: Accepting a fake note can lead to personal liability and disciplinary action.

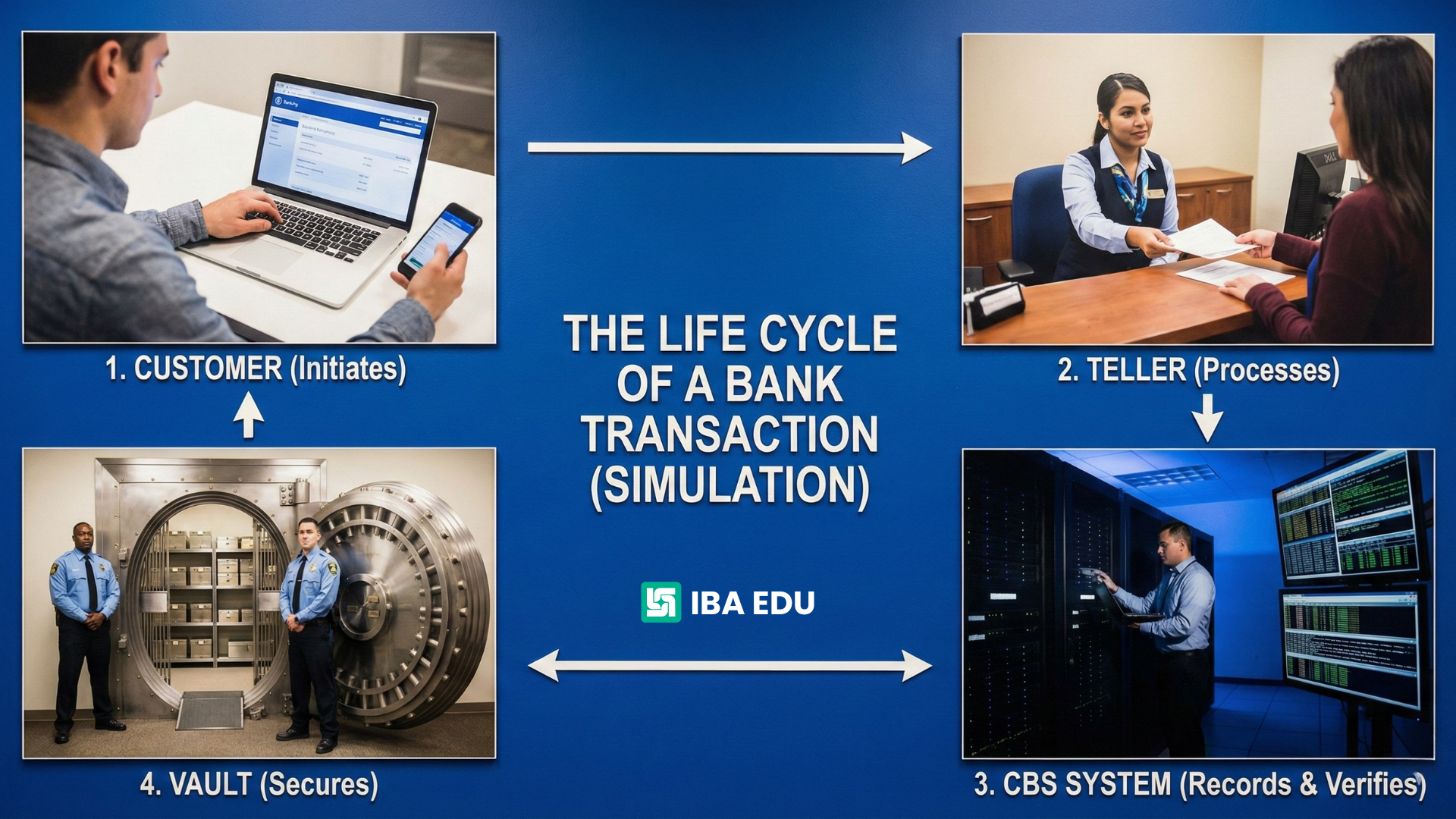

3. Core Banking Solution (CBS) Navigation

In 2026, software like Finacle or BaNCS is the backbone of banking.

-

Practical Knowledge: You need to know how to navigate transaction menus, handle “Suspense Accounts,” and pull daily reports without help.

-

The IBA EDU Advantage: Our Mastering Teller Course provides simulated environments to practice these entries before you ever step foot in a real branch.

4. KYC & AML Compliance: The Shield

Banking is no longer just about cash; it’s about Compliance.

-

KYC (Know Your Customer): Understanding OVDs (Officially Valid Documents) like Aadhaar, PAN, and Voter ID.

-

AML (Anti-Money Laundering): Spotting “Red Flag” transactions. If a customer who usually deposits ₹5,000 suddenly brings in ₹5 Lakhs, do you know the protocol?

5. High-Pressure Accuracy (The “Rush Hour” Mindset)

The bank lobby can be chaotic. Customers are in a hurry, and phones are ringing.

-

The Skill: Maintaining a “Zero-Error” mindset while multitasking.

-

Practice: We teach you the “Verification Loop”—a mental checklist that ensures every entry is perfect before you hit ‘Enter.’

6. The “Teller-to-Sales” Cross-Selling Secret

The best tellers aren’t just processors; they are revenue generators.

-

Opportunity: While counting cash, a teller can identify if a customer needs a Credit Card, a Personal Loan, or a Fixed Deposit.

-

Growth: This is the fastest way to get promoted to a Relationship Manager (RM) role.

7. Resolving “Cash Differences”

What happens if your drawer is “short” by ₹500 at the end of the day?

-

The Protocol: Most freshers panic. We teach you how to audit your vouchers, check your system entries, and trace the error systematically.

Your Career Reset Begins Today

The difference between a “job seeker” and a “banking professional” is certification. Don’t wait for a bank to train you—arrive already trained.

Why Choose IBA EDU?

-

Industry Veterans: Courses designed by ex-bankers.

-

Practical Simulations: No boring theory; just real-world banking.

-

Affordable Excellence: Get the full Mastering Teller Bundle for just ₹999.

[Yes! I Want to Become a Professional Teller – Enroll Now]

Frequently Asked Questions (FAQs) for Aspiring Bank Tellers

Q1: Can I get a bank teller job in India without any prior experience?

A: Yes! While many banks prefer experienced candidates, you can bridge the “experience gap” by completing a professional certification like the IBA EDU Mastering Teller Course. This proves to recruiters that you are already trained in cash handling, KYC, and CBS software, making you “Day 1 Ready” without the bank needing to train you from scratch.

Q2: What is the starting salary for a Bank Teller in India in 2026?

A: In 2026, the average starting salary for a bank teller in top private banks (like HDFC, ICICI, or Axis) ranges from ₹3.5 LPA to ₹5 LPA. This often includes additional performance-based incentives for cross-selling and accuracy.

Q3: Is the Bank Teller role a good career start for fresh graduates?

A: Absolutely. The teller position is the “heart” of the branch. It provides you with a deep understanding of banking operations, customer service, and financial products. Successful tellers at IBA EDU often transition into higher-paying roles like Relationship Manager or Branch Operations Manager within shorter period of time.

Q4: Do I need to be a math expert to handle cash at a bank?

A: You don’t need to be a mathematician, but you do need numerical accuracy. Modern banking relies heavily on cash counting machines and CBS software. Our course focuses on teaching you the “Double-Check” system and manual verification techniques so you never have a “Cash Difference” at the end of the day.

Q5: What are the eligibility criteria for the IBA EDU Mastering Teller Course?

A: This course is specifically designed for college students, fresh graduates (any stream), and entry-level professionals looking to pivot into the banking sector. There is no age bar, provided you have a basic understanding of computer operations and a drive to learn.

Q6: Does digital banking mean there will be fewer teller jobs in 2026?

A: While digital banking is growing, the demand for human interaction and physical cash management remains high in India. Banks are actually hiring more “Universal Tellers” who can handle both cash and digital service requests. Certification ensures you stay relevant in this evolving market.

Q7: How long does it take to complete the Mastering Teller certification?

A: The IBA EDU course is designed for high-impact learning. You can complete the core modules and receive your certification in just a few weeks, allowing you to start applying for high-growth banking roles almost immediately.

Stop worrying about the ‘Experience Gap.’

Join the IBA EDU Mastering Teller Course today and gain the confidence to handle any cash counter.