Currently Empty: ₹0.00

Blog

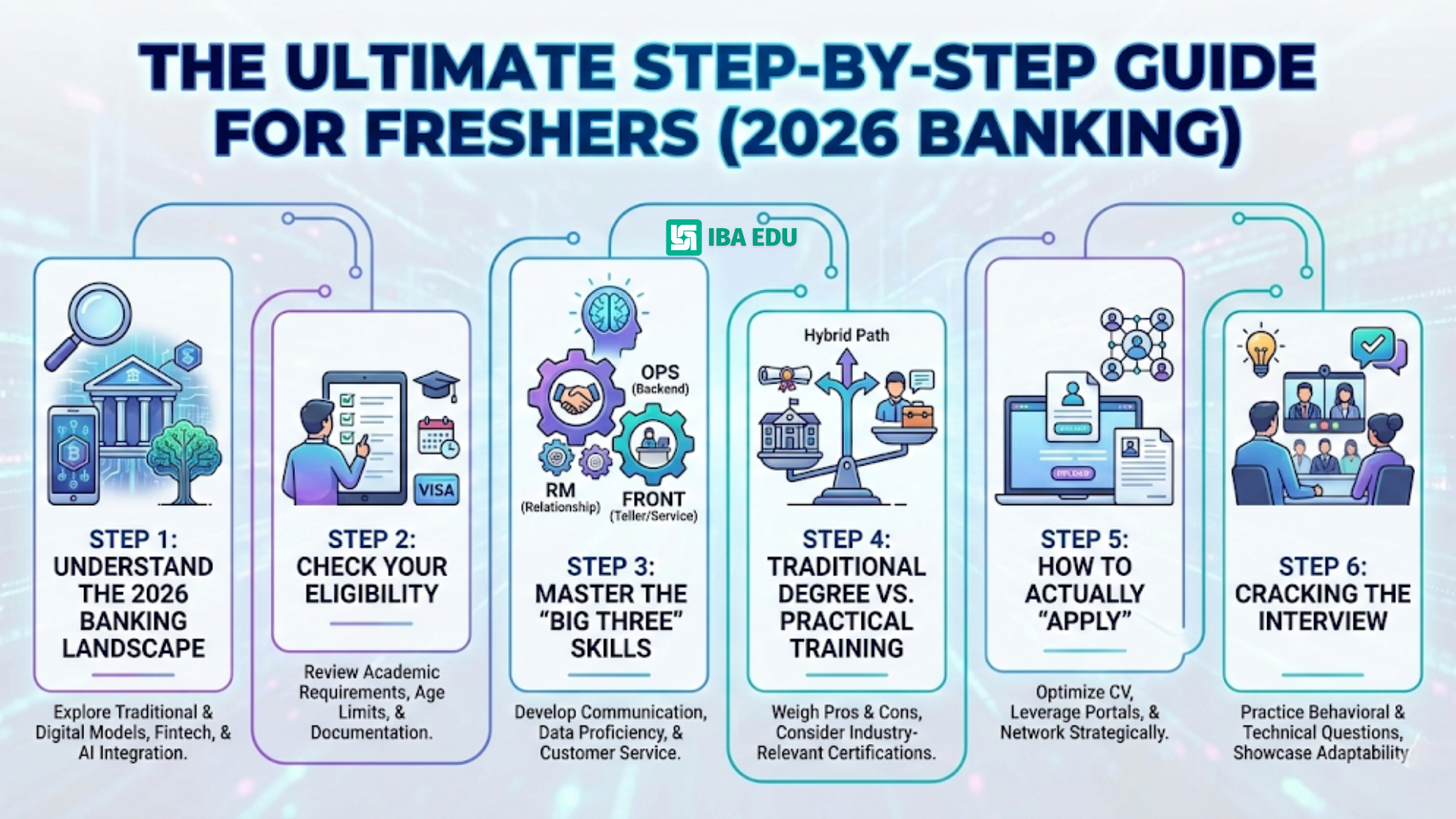

How to Get a Bank Job in 2026: The Ultimate Step-by-Step Guide for Freshers

Stop Applying Blindly.

Start Preparing Practically.

Turn your degree into a career. In 2026, banks aren’t looking for graduates—they are looking for job-ready professionals who can handle a workstation on Day One.

Enroll in the 2026 Banking Mastery Program | Download the ‘Bank Job’ Success Checklist

How to Get a Bank Job in 2026: The Ultimate Step-by-Step Guide for Freshers

So, you want to build a career in banking. It’s a smart move. In 2026, the Indian banking sector remains one of the most stable, high-paying, and prestigious industries for freshers. However, there is a catch: The way banks hire has changed.

Thousands of graduates apply every day, but only the top 1% get hired by private giants like HDFC, ICICI, and Axis Bank. This guide is your “unfair advantage” to join that 1%.

Step 1: Understand the 2026 Banking Landscape

Before you apply, you need to know where you fit. The banking world is divided into two main sectors, and the requirements for each are different:

-

Public Sector Banks (PSUs): These require clearing entrance exams like IBPS or SBI PO. It is a long, competitive road focused on aptitude.

-

Private Sector Banks: These prioritize skills and practical knowledge. They hire through interviews and specialized training certifications. This is the fastest route for a fresher to start a career.

Step 2: Check Your Eligibility

To be considered for entry-level banking jobs, ensure you meet these basic criteria:

-

Education: A Bachelor’s degree (B.Com, BBA, BSc, or BA) with a minimum of 50% aggregate.

-

Age: Usually between 21 and 26 years for fresher roles.

-

Communication: Proficiency in English and your local language is essential for customer-facing roles.

Step 3: Master the “Big Three” Skills

In 2026, a degree is just the entry ticket. To actually get the job, you need to demonstrate these three core competencies:

1. Operational Accuracy

Can you handle a live teller counter? Do you understand how to balance cash or process a cheque? Banks hate “training” freshers from scratch. Showing you already have workstation experience makes you an instant hire.

2. Compliance & KYC Knowledge

Banking is built on trust and rules. You must understand KYC (Know Your Customer), Anti-Money Laundering (AML) protocols, and RBI guidelines.

3. The “Banker’s Persona”

This involves high emotional intelligence (EQ), professional grooming, and the ability to handle high-pressure situations with a smile.

Step 4: Traditional Degree vs. Practical Training

Why do most graduates struggle? Because they are over-educated in theory and under-trained in practice.

| Feature | Traditional Degree | IBA EDU Practical Training |

| Focus | History of Banking | Live Workstation Practice |

| Confidence | Low (Textbook only) | High (Mock Branch experience) |

| Recruiter View | Just another candidate | “Job-Ready” Professional |

| Interview Prep | General | 1-on-1 Mock Banker Interviews |

Step 5: How to Actually “Apply”

Don’t just upload your resume to a portal and pray. Follow this strategic approach:

-

Optimize Your Resume: Use keywords like KYC compliance, Retail Banking, Customer Relationship Management, and Operational Accuracy.

-

Highlight Practical Training: If you’ve completed a course at IBA EDU, put your “Live Branch Experience” at the very top.

-

Leverage LinkedIn: Connect with HR managers and alumni from your target banks.

Step 6: Cracking the Interview

The final hurdle is the interview. Private banks use Situation-Based Questions to test your instincts.

-

Typical Question: “What would you do if a customer insists on withdrawing cash without an ID?”

-

The Theory Answer: “I would tell them the rules.” (Waitlisted)

-

The IBA EDU Answer: “I would calmly explain the RBI compliance requirements while offering to help them fetch a digital ID, ensuring we maintain the relationship without compromising security.” (Hired)

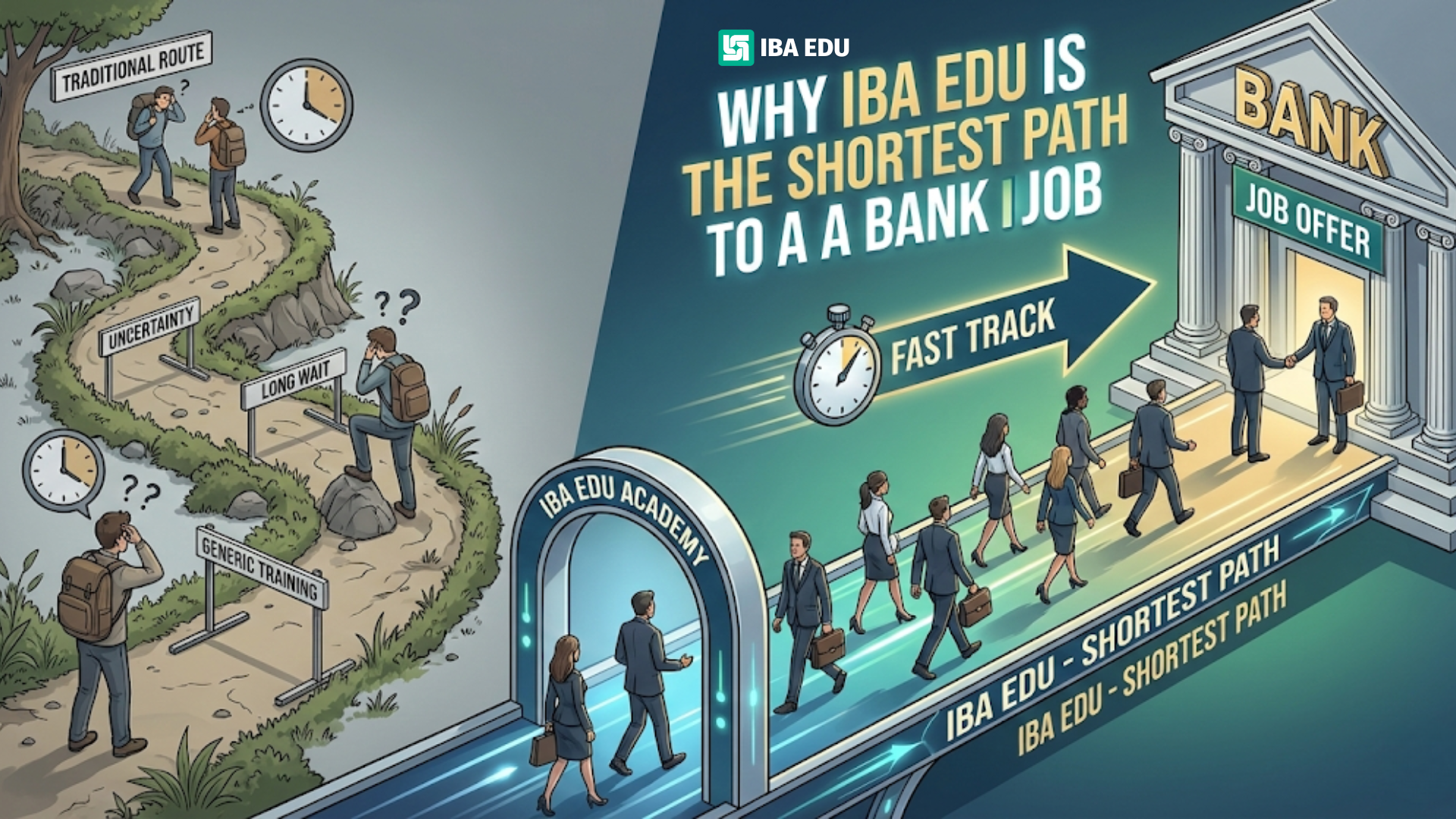

Why IBA EDU is the Shortest Path to a Bank Job

At IBA EDU, we don’t just teach you about banking; we let you live it. Our 2-month program is taught by experienced bankers in a simulated environment.

By the time you walk into an interview, you’ve already:

-

Balanced a live cash drawer.

-

Processed real-world KYC documents.

-

Practiced mock interviews with the people who used to do the actual hiring.

Ready to Experience Banking Before You Enter It?

Don’t wait for luck. Build the skills that make luck irrelevant. Join our 2026 Summer Internship Program and secure your future.

👉 Apply for the IBA EDU Banking Mastery Program

👉 Take the Free Career Assessment Quiz

IBA EDU — Where Banking Careers Are Built Practically, Not Theoretically.